at another, large blog, someone commented that "Krugman = lagging indicator." The person meant it sarcastically, but rephrased as "pundits = lagging indicator," it is true. It has been proven over and over again that pundit opinion as a whole

trends. Which means that it misses turning points, which is why the KISS method of sticking with the LEI is more successful. As the economic data has deteriorated in the last few months, the range of generally accepted opinion has moved Gloomier and Doomier. It will continue to move that way until AFTER the next turning point.

More specifically, this weekend check out the Barron's website's data section, and see what insiders are doing, since individual investor sentiment is totally spooked by the "Hindenberg omen." Like the "Digby put" almost 2 months ago, it may actually be the "Hindenberg

omen." Insider buying vs. selling will tell us so.

the reduction of 2nd quarter GDP was made official. The economy is in the doldrums, nearly completely stalled. Durable goods orders, a leading indicator, tanked. New and existing home sales also declined, completing the collapse since the expiration of the $8000 tax credit.

One other item of interest, quite overlooked in the media, was the release of loan data for the second quarter by the Fed. Loans typically do not bottom until well after the bottom of a recession. They are badly lagging indicators, but they do confirm a turn. As it happens, a few of the series did actually turn up. Most all of the rest continued to decline, but at a much lower rate than they had up until this year. Too early to say they've turned, but they look like they are getting ready to turn.

The

Mortgage Bankers' Association reported that "the Refinance Index increased 5.7 percent from the previous week

and is at its highest level since May 1, 2009. The seasonally adjusted Purchase Index increased 0.6 percent from one week earlier." The Purchase index continues to tell us that we have hit bottom, but without a significant bounce back yet. Refinancing tells us that household debt as a percentage of disposable income is going down, probably substantially. This is a good sign for the future.

The

ICSC reported same store sales for the week ending August 21 rose 2.3% vs. a year earlier, and declined -0.4% from the prior week.

Shoppertrak, on the other hand, reported that for the week ending August 21, YoY sales were up 4.5%, and down -0.4% vs. the prior week. The ICSC report concerns me, as this is the poorest YoY showing in several months, and the 4th straight week of WoW declines. Are consumers growing fearful again?

Gas prices decreased $.05 to $2.70 a gallon, at the low end of the range since May. At 9.373 million barrels consumed a day vs. 9.105 the same week last August, we continue to run ahead of last year, indicating expansion.

The

BLS reported 473,000 new jobless claims, back in its 8 month range. We won't know if the increase we saw since early June has due primarily to state and local government and census layoffs until we see the jobs numbers a week from today.

Railfax continued to show renewed strong growth vs. last year in all 4 sectors: Cyclical, intermodal, baseline, and total traffic all continued to move sharply up, and intermodal traffic hit a new high! Auto carloads also continued to rebound strongly, although waste and scrap metal remained at last year's levels. In the last few weeks, I have written tht rail traffic has suggested that the double-dip was

right now. Last week a reader asked in the comments

Question: when you say that the rail traffic suggests the double dip is right now, does that mean we are already on the way up out of it, given that traffic is turning back up after having been down?

Answer: yes it may be so. The bottom line is, indicators seem to behave differently in deflation vs. inflation, in that lead times become much more compact. Rail traffic has suggested that the downturn foreseen in the LEI beginning in April has already been happening. Rail traffic may now be telling us that the downturn in the

private vs. public sector may be abating.

The

American Staffing Association reported that for the week ending August 15, temporary and contract employment increased by 1.31%, pushing the index to a two year high of 95.0. This series is a leading indicator for jobs, and again suggests that the private sector is continuing to grow.

M1 declined -0.6% in the last week, but was up 1.0% month over month, and up 4.4% YoY, so “real M1” is up 3.1%.

M2 increased less than 0.1% in the last week, and is up 0.3% month over month, and up 2.4% YoY, so “real M2” is up 1.1%. We have never had a recession without a negative real M1 reading, so this is encouraging, although the YoY trend remains down. Additionally, I would like to see real M2 up over 2.5% to feel confident that there will be no double-dip.

Weekly

BAA commercial bond rates dropped .22% more last week to 5.56%, a decline of 0.76% in 9 weeks! This is simply totally inconsistent with the notion that another deflationary bust has started and creditworthiness is about to become an issue.

The

Daily Treasury Statement as of August 25 (18 reporting days into the month) shows $116.4 B has been collected vs. $110.2 B a year ago, a gain of 5.6%. For the last 20 reporting days, we are up 5.8%, $125.0 B vs. $119.2 B. This is towards the low end of advances since the series turned positive YoY in March. This suggests to me that private sector employment is not continuing to improve relative to last year, although small positive growth may be taking place.

For the first time in awhile, almost all of the weekly indicators were positive, although their strength varied. Mortgage applications and rail traffic are particularly encouraging. The ICSC same store sales figure does concern me, however. Next week we'll get the jobs report, and what I will be particularly watching is whether weakness remains concentrated in the real estate/construction and government jobs area where stimulus programs expired, or whether the weakness is spreading out.

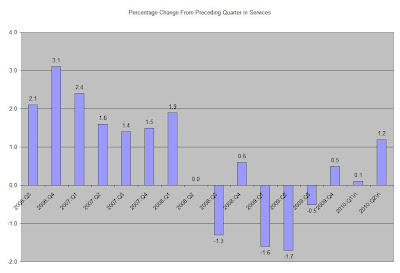

First, note that PCE expenditures are broken down into services, non-durable and durable expenditures.

First, note that PCE expenditures are broken down into services, non-durable and durable expenditures. Services is the largest area of expenditures, accounting for 65% of PCEs. The three largest areas of service expenditures are housing, health care and "other".

Services is the largest area of expenditures, accounting for 65% of PCEs. The three largest areas of service expenditures are housing, health care and "other". After the "other" category in the non-durable category, we see that food, clothing and energy are the largest expenditures of the non-durable category.

After the "other" category in the non-durable category, we see that food, clothing and energy are the largest expenditures of the non-durable category. And in the durable goods category, we see that recreational goods (think really big toys), cars and furnishings are the biggest components.

And in the durable goods category, we see that recreational goods (think really big toys), cars and furnishings are the biggest components.