First, he notes that I plotted a non-logarithmic chart of productivity growth instead of a logarithmic one, the implication being that a logarithmic chart would somehow arrive at a different conclusion. Of course, the first question a reader of Mr. Scott's article should ask is, "if this chart is so damning, why did Mr. Scott not include it is his article? Here, Mr. Scott is engaging in a standard legal defense tactic: when the data is against you, question it in some manner without showing proof. This is also a very popular tactic among right wing radio personalities, especially in regards to global warming data. The answer is clear: the chart in logarithmic scale and normal scale show the exact same situation: a chart that shows a clear expanssion of US manufacturing output. See this on page 5 of the complete PDF's from the Federal Reserve. Secondly, according to the Federal Reserve, growth in manufacturing output did not decrease after 2000 as Mr. Scott claims. According the the same source (the Federal Reserve's industrial production chart), manufacturing output increased from 2000 until the end of 2007. At the same time, manufacturing jobs dropped by about 5 million. This eviscerates the root of his argument.

Next, Mr. Scott notes that my co-blogger and I used a chart of manufactured imports and manufacturing jobs compared same to to demonstrate there is no relationship between the trade deficit and manufacturing employment. What Mr. Scott fails to recognize is this: if the US were replacing manufactured goods produced in the US with manufactured imports from other countries, there would be a relationship between imports of manufactured goods and manufacturing jobs. Yet as the US started to import more manufactured goods there were not a concomitant decrease in employment jobs. In addition, my co-blogger Silver Oz demonstrates this lack of causal relationship between the trade deficit and manufacturing in this article, titled, Free Trade Is Not the Job Killer.

Finally, while I am sure that Mr. Scott is a fine economist, it is patently obvious he engages little with real-world manufacturing executives. As a tax attorney, I am regularly consulted on the question of adding physical infrastructure to factories at the expense of employees. When asked these questions, I usually ask why. And the answer is always the same: "more output per unit of input." The classic John Henry story is playing out across all industries with remarkable alacrity. In fact, if you look at the change of physical infrastructure in manufacturing over the last 20 years, you will see the exact same pattern across all industries: an increase in equipment at the expense of employees.

In short, Mt. Scott has a preconceived view of the world (all trade is bad) and is attempting to fit the facts to his view. I would encourage him to broaden his horizons, leave his ivory tower and engage some business owners to see what they think. However, I would also encourage Mr. Scott to use the services of a third party in his interactions, as people skills are obviously not his strong suit.

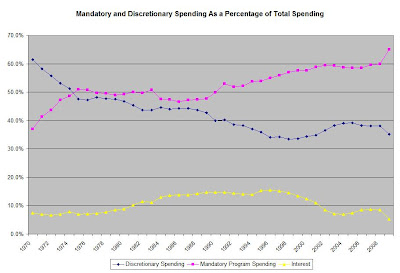

The above chart breaks federal spending down into mandatory, discretionary and interest payments. Mandatory spending has increased from a little under 40% of the federal budget in 1970 to right around 60% over the last few years. Discretionary spending has decreased from right around 60% in 1970 to a little under 40% over the last few years. The progression of mandatory spending is at the center of much of the budgetary concern in Washington and the public.

The above chart breaks federal spending down into mandatory, discretionary and interest payments. Mandatory spending has increased from a little under 40% of the federal budget in 1970 to right around 60% over the last few years. Discretionary spending has decreased from right around 60% in 1970 to a little under 40% over the last few years. The progression of mandatory spending is at the center of much of the budgetary concern in Washington and the public.